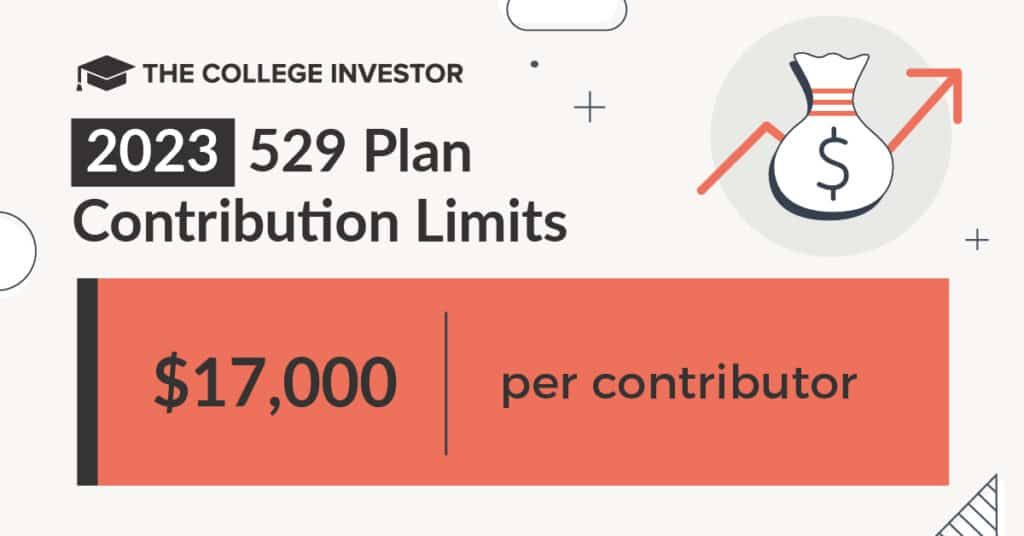

Ohio 529 Contribution Limit 2024. The deduction is not limited to the savings. Typically, you can contribute up to $18,000 a year (or $36,000 for couples) to one or more 529 college savings plans without incurring the gift tax.

Ohio house bill 155 implements the federal able act in ohio. If one of your new year resolutions is to start saving for your child’s education after high school, ohio’s 529 plan, collegeadvantage, makes it simple to do.

Ohio 529 Contribution Limit 2024 Images References :

Source: emeliayzabrina.pages.dev

Source: emeliayzabrina.pages.dev

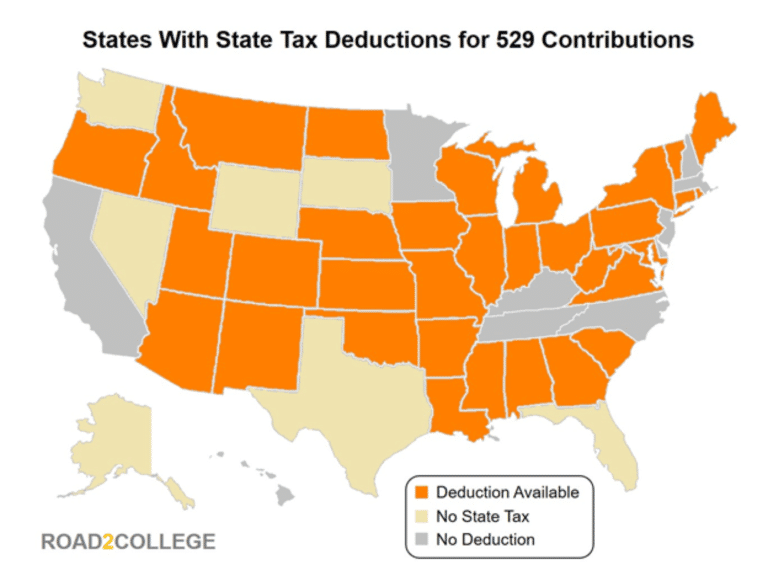

529 Plan Limits 2024 Pdf Kary Nikolia, Ohio offers a state tax deduction for contributions to a 529 plan of up to $4,000 per year for any filing status.

Source: kayyleshia.pages.dev

Source: kayyleshia.pages.dev

Ohio 529 Contribution Limit 2024 Tax Gerry Juditha, 529 plans do not have annual contribution limits.

Source: gustaymarget.pages.dev

Source: gustaymarget.pages.dev

529 Plan Contribution Limits 2024 Pdf Download Zita Jerrine, The maximum contribution limit pertains to each beneficiary.

Source: arielqgianina.pages.dev

Source: arielqgianina.pages.dev

529 Annual Contribution Limits 2024 Dianne Kerrie, In 2024, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709.

Source: tovaqclemmie.pages.dev

Source: tovaqclemmie.pages.dev

529 Plan Contribution Limits 2024 Aggy Lonnie, In 2024, you can contribute up to $18,000 per beneficiary per year before you’d need to file irs form 709.

Source: albinabnoreen.pages.dev

Source: albinabnoreen.pages.dev

529 Plan Contribution Limits 2024 Sayre Courtnay, According to the college savings plan network, state residents can deduct annual contributions to an ohio 529 plan on their taxes — up to $4,000.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: perlaqjacquette.pages.dev

Source: perlaqjacquette.pages.dev

529 Plan 2024 Contribution Limits Dana Milena, Review how much you can save for college in these plans.

Source: www.mybikescan.com

Source: www.mybikescan.com

2024 529 Contribution Limits What You Should Know MyBikeScan, Learn about the contribution and account balance limits on 529 plans and the difference in contribution limits among states.

Source: oreleewquinn.pages.dev

Source: oreleewquinn.pages.dev

Contribution Limit For 529 Plan 2024 Rosy, The aggregate 529 contribution limit varies across states from $235,000 to greater than $550,000, with the threshold set to ensure that potential costs for higher.

Source: tovaqclemmie.pages.dev

Source: tovaqclemmie.pages.dev

529 Plan Contribution Limits 2024 Aggy Lonnie, Although these may seem like high caps, the limits apply to every type of 529 plan.

Posted in 2024